colorado electric vehicle tax credit 2020 form

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. You can lease an electric vehicle instead and get 2500 by the end of the year.

Creating The Sustainable Electric Vehicle Revolution

November 17 2020 by electricridecolorado.

. It is a great resource for anyone seeking information on vehicle electrification in Colorado. The Chevrolet Bolt EV. 1500 between 2021 to 2026.

DR 0366 - Rural Frontier Health Care Preceptor Credit. Since its inception in 2013 the Charge Ahead Colorado program has made awards for more than 1000 EV charging stations across the state. The dashboard allows people to view information on EV deployment current statewide EV infrastructure and details on charging use for a selected number of stations.

And improve the safety of Colorados transportation network. DR 0375 - Credit for Employer Paid Leave of Absence for Live Organ Donation Affidavit. Program objectives include improving air quality encouraging deployment of EVs across the state and supporting implementation of the Colorado Electric Vehicle Plan 2020.

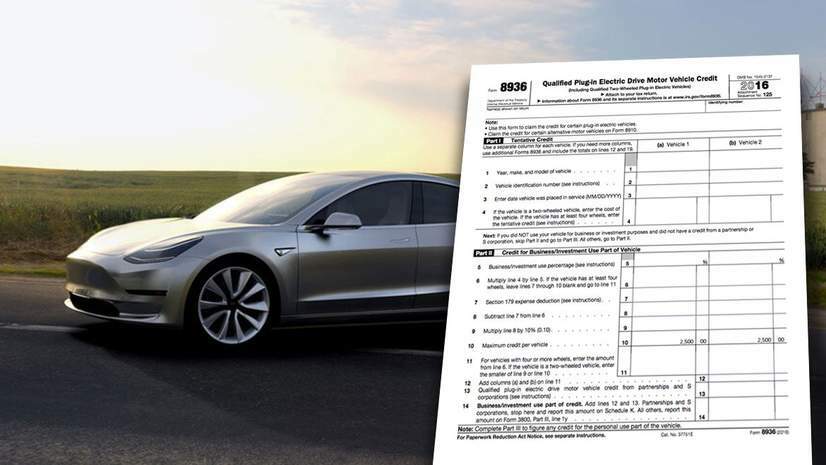

Large-scale transition of Colorados transportation system to zero emission vehicles with a long-term goal of 100 of light-duty vehicles being electric and 100 of medium- and heavy-duty vehicles being zero emission. Information about Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file. Examples of electric vehicles include.

The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. Filemytaxes november 1 2021 tax credits. The credits decrease every few years from 2500 during January 2021 2023 to 2000 from 2023-2026.

Tax credits can be stacked with federal EV incentives and will decrease in value after 2020 dropping to 2500 in 2023 and 2000 in 2026. Alternative Fuel Vehicle AFV Tax Credit. Colorado Electric Vehicle Tax Credit.

For example if you are filing a return for 2018 you must include the credit forms for 2018 with your return. DR 1316 - Colorado Source Capital Gain. Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a.

If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. Colorados tax credits for EV purchases.

Sales of 2022 of Electric Vehicles continues go grow. For tax years January 1 2010 January 1. Truck Credits for Electric and Plug-in Hybrid Electric Vehicles Colorado allows innovative motor vehicle and innovative truck credits for the purchase lease or conversion of motor vehicles trucks and trailers that use certain alternative fuels.

Many leased EVs also qualify for a credit of 2000 this. Credit Values for Purchase Lease or Conversion of a Qualifying Motor Vehicle or Truck Select and enter the correct amount from this table on line 9 of the form. Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds.

To claim your tax. Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits.

New EV and PHEV buyers can claim a 5000 credit on their income tax return. About Form 5695 Residential Energy Credits. Transfer the allowable credit amount to the appropriate income tax form where requested.

Be sure to use the form for the same tax year for which you are filing. In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020. Some dealers offer this at point of sale.

The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022. In 2020 Colorado updated and released the Colorado Electric Vehicle Plan 2020 which envisions.

To meet these goals. Contact the Colorado Department of Revenue at 3032387378. CEO and Atlas Public Policy will continue to refine this dashboard over time.

FDR 0617 071321 COLORADO DEPARTMENT OF REVENUE TaxColoradogov DONOTSEND Table 1. The Chevy Bolt EV is GMs first long-range all-electric vehicle. The credits which began phasing out in January will expire by Jan.

The table below outlines the tax credits for qualifying vehicles. 112017 112020 112021 112023 but prior to. Its a compact utility vehicle with 238 miles of range and a starting price of 37500 before incentives.

Examples of electric vehicles include. DR 0350 - First-Time Home Buyer Savings Account Interest Deduction. If filing by paper visit the Credits Subtractions Forms page to download the forms andor schedules needed to file for the credits listed below.

Both the state and the federal government have tax credits that you can take advantage of when purchasing an electric vehicle. I am completing Form 8936 for a 2019 Tesla purchase to receive the electric vehicle credit. If you purchased your ev more than 3 years ago and the vehicle is still eligible for the tax credit you can file an amended return to claim your credit.

This tax credit goes down to 2500 on January 1 2021 so buy your car now to take advantage of the 4000 credit. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. 112020 112021 112023 112026.

Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. And improve the safety of Colorados transportation network. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits.

DR 0347 - Child Care Expenses Tax Credit. If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit. If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit.

In April 2020 CDOT released the Colorado Electric Vehicle EV Plan 2020 establishing a long-term goal of 100 of light-duty vehicles LDV being electric and 100 of medium- and heavy-duty vehicles being ZEVs. DR 0346 - Hunger Relief Food Contribution Credit. Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs.

A separate form must be completed for each qualifying vehicle. This will be accomplished by. Hybrid electric vehicles and trucks Manufactured and converted electric and plug-in hybrid electric motor vehicles and trucks that are propelled to a significant extent by an electric motor that has a battery capacity of at least 4 kWh and is capable of being recharged from an external power source CNG LNG LPG or hydrogen vehicles.

As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits.

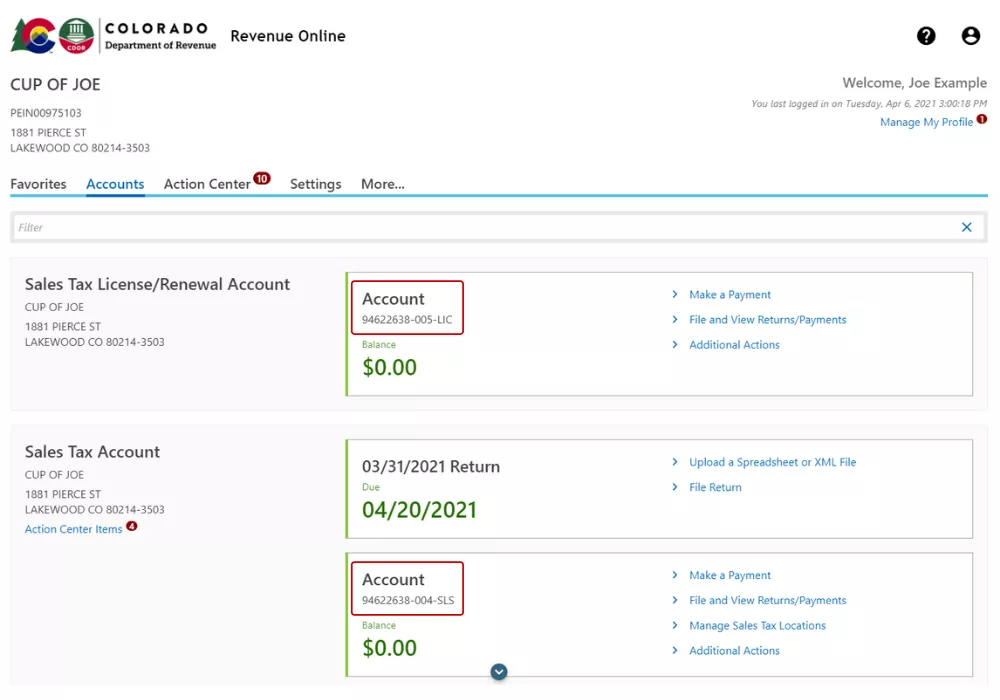

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

4 Best Hybrid And Electric Suvs For The Money U S News

St Basile Honda Honda Dealership On Montreal S South Shore

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

2022 Mazda Mx 30 First Drive Hits A Few High Notes Falls Way Short On Range Forbes Wheels

Parler Ceo Says Service Dropped By Every Vendor Could End Business Deadline

Electric Cars 101 Answers To Your Ev Questions Consumer Reports

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

Electric Car Electric Bill Off 70

How To Claim An Electric Vehicle Tax Credit Enel X

Commercial Lending Services Taylor Ford

St Basile Honda Honda Dealership On Montreal S South Shore

Indirect Tax Kpmg United States

Affiliate Programs For Sherwood Chevrolet See Current Promotions