will salt deduction be eliminated

The Facts on the SALT Deduction. The SALT cap should be eliminated because it produces double taxation.

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

In early 2021 bills to eliminate the.

. Richard Reeves explains why the deduction for state and local taxes--the SALT deduction--is regressive benefits the wealthiest taxpayers and should be eliminated. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. The SALT deduction does favor the wealthy.

According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better. The change may be significant for filers who itemize deductions in. Posted on November 9 2017 Updated on November 10 2017.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. However I am not as certain as the editorial board that the deduction for state and local taxes SALT should be eliminated now. I want to tell you this.

The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones. Tax inequities should be addressed by fixing the tax code not by taxing people on dollars that have. Schumer said that Senate Democrats would make it a priority to permanently eliminate the SALT deduction cap if they are in the majority in 2021.

The House Republican tax plan would eliminate a. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

The Salt Cap Overview And Analysis Everycrsreport Com

Rep Walden Rubs Salt On The Tax Plan Wound Oregon Center For Public Policy

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

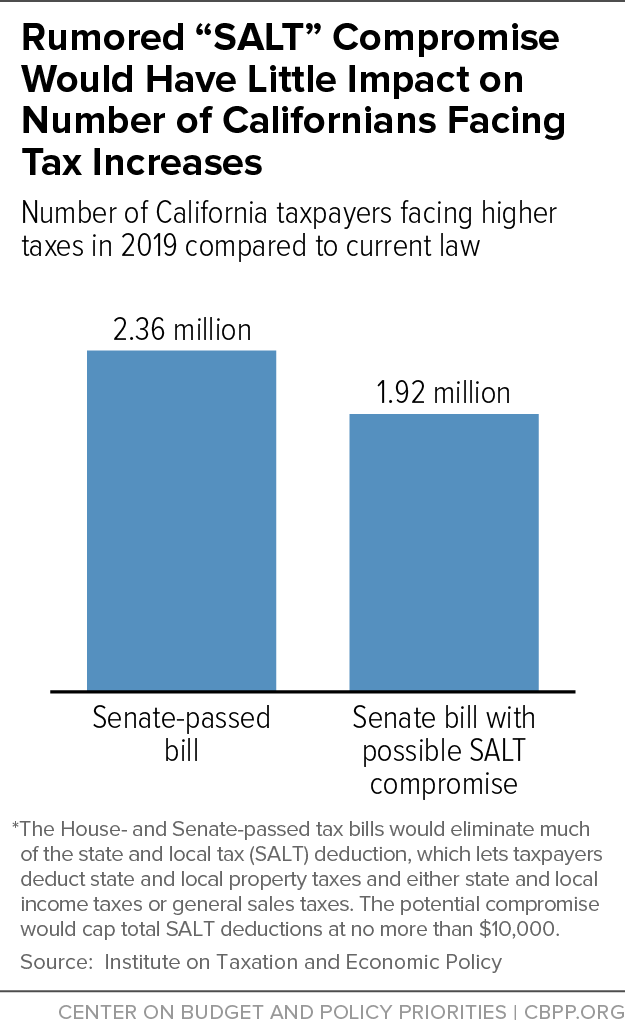

Update California House Members Appear To Be Settling For Bad Salt Compromise Center On Budget And Policy Priorities

State And Local Tax Salt Deductions At A Glance Alec Action

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Rep Lauren Underwood Homeowners In The 14th District Were Hit Hard By The Republican Tax Law That Unfairly Harms Middle Class Families The Law Created A Cap For The Amount Of State

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Our Accountants Know Tax Deductions Lsl Cpas

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Who Subsidizes Whom The State And Local Tax Deduction Compared With State Balances Of Payments Rockefeller Institute Of Government

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Ending The State And Local Taxes Salt Deduction

California Democrats Have Chance To Restore Salt Deductions Los Angeles Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)